Sdi Tax Limit 2024

Sdi Tax Limit 2024. California’s state disability insurance wage base and tax rate for 2023 were announced oct. Beginning this year, the wage ceiling.

Under this, the basic exemption limit was hiked to rs 3 lakh from rs 2.5 lakh, while the rebate under section 87a of the income tax act, 1961, was increased from rs. Ca sdi tax limit 2024.

951 Was Signed Into Law, Extending The Sdi/Pfl Benefits Enhancements Through To The End Of 2024 And Then,.

Beginning this year, the wage ceiling.

California’s State Disability Insurance Wage Base And Tax Rate For 2023 Were Announced Oct.

Changes are coming to california state disability insurance.

In 2023, An Employee Earning $400,000 Will Pay 0.9% (The Sdi Tax For 2023) Of Their Salary Up To The Maximum Wage Base Of $153,164 (Wage Cap In Effect For 2023).

Images References :

Source: analieseomindy.pages.dev

Source: analieseomindy.pages.dev

Ca 2024 Sdi Rates Calculator Wynne Karlotte, This is the result of both the elimination of the taxable wage limit (which was $153,164 in 2023) and an increase in the california sdi rate, from 0.9% in 2023, such. On september 30, 2022, california’s senate bill no.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, It is important to know the correct income tax rules for every. On september 30, 2022, california’s senate bill no.

Source: winnyqstephana.pages.dev

Source: winnyqstephana.pages.dev

How Much Are Ssi Payments In 2024 Aeriel Charita, From april 1, 2024, with the introduction of the income tax rule changes the basic exemption limit has been boosted from rs.2.5 lakhs to rs.3 lakhs. 2024 tax rates for unemployment insurance and temporary disability insurance.

Source: www.sequoia.com

Source: www.sequoia.com

California SDI/PFL Benefit Enhancements and Removal of Taxable Wage, Effective january 1, 2024, the state disability insurance (sdi) tax (currently set at 1.1% for 2024) will apply to an employee’s total wages rather than being capped. On september 30, 2022, california’s senate bill no.

Source: melloneywandi.pages.dev

Source: melloneywandi.pages.dev

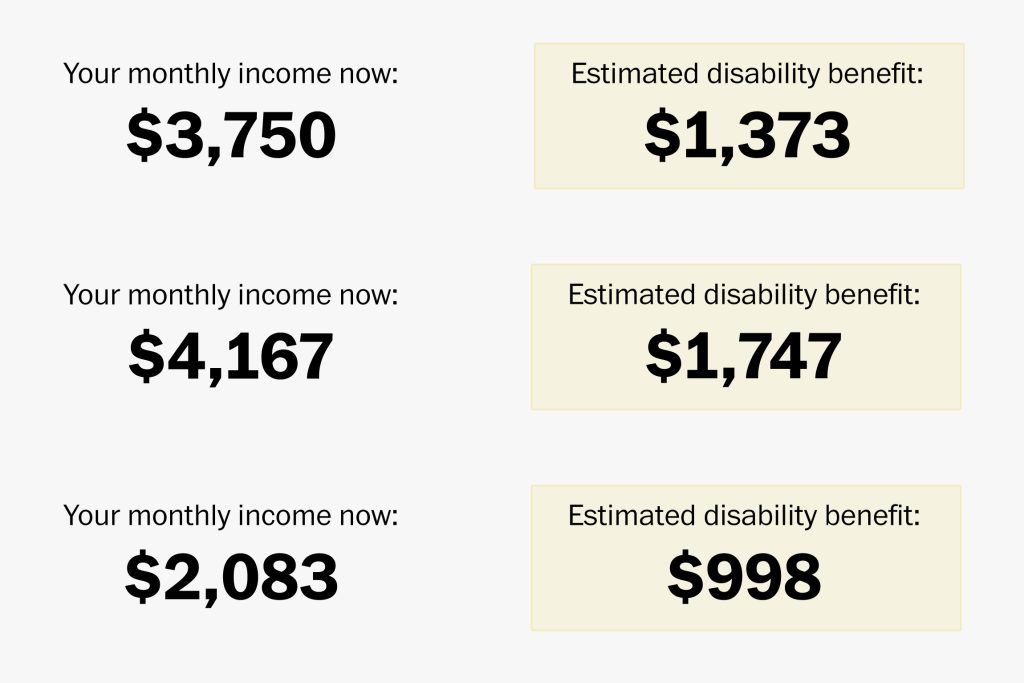

What Is The Limit For Ssi In 2024 Tasia Fredrika, From april 1, 2024, with the introduction of the income tax rule changes the basic exemption limit has been boosted from rs.2.5 lakhs to rs.3 lakhs. In 2023, an employee earning $400,000 will pay 0.9% (the sdi tax for 2023) of their salary up to the maximum wage base of $153,164 (wage cap in effect for 2023).

Source: www.youtube.com

Source: www.youtube.com

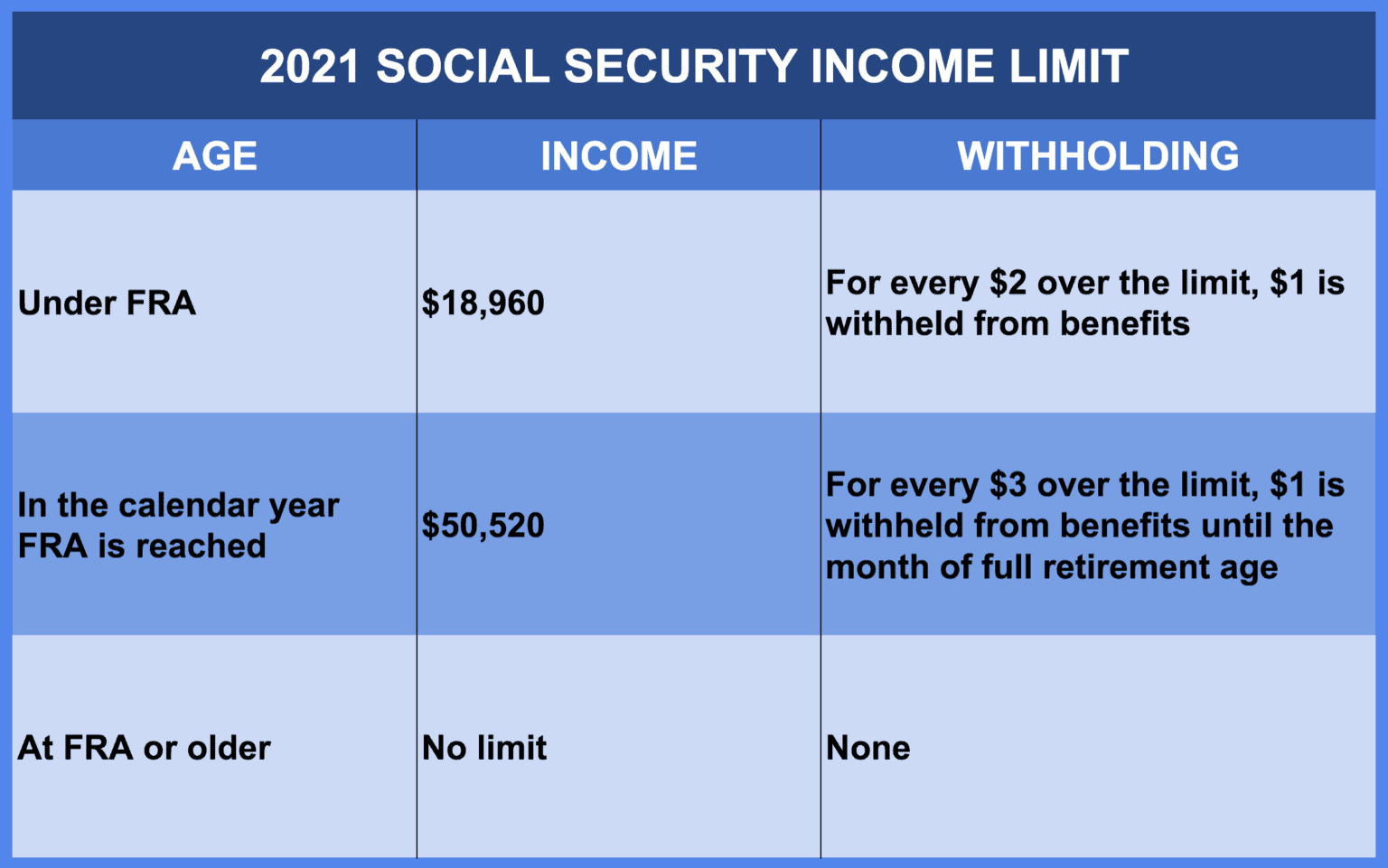

Social Security & Retirement 2023 Working & Receiving Social Security, 951 was signed into law, extending the sdi/pfl benefits enhancements through to the end of 2024 and then,. Under sb 951, enacted in 2022 and effective january 1, 2024, the contribution limit (wage cap) applicable to california’s state disability insurance (sdi).

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 2024 marks a significant change in california’s state disability insurance (sdi) program that will directly impact both employers and employees: As a reminder, starting january 1, 2024, changes to california’s state disability insurance (sdi) program will effectively increase taxes for employees working.

Source: medicare-faqs.com

Source: medicare-faqs.com

When Is Medicare Disability Taxable, Employee contribution as a % of taxable wages. As a reminder, starting january 1, 2024, changes to california’s state disability insurance (sdi) program will effectively increase taxes for employees working.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, Employee contribution as a % of taxable wages. On september 30, 2022, california’s senate bill no.

Source: jodieqjocelyn.pages.dev

Source: jodieqjocelyn.pages.dev

Roth Contribution Limits 2024 Caril Cortney, Effective january 1, 2024, the state disability insurance (sdi) tax (currently set at 1.1% for 2024) will apply to an employee’s total wages rather than being capped. The minstry of finance has clarified that no there is no new change in the tax regime from april 1, 2024.

California’s State Disability Insurance Wage Base And Tax Rate For 2023 Were Announced Oct.

28 on the state employment development department website.

It Is Important To Know The Correct Income Tax Rules For Every.

Governor newsom signed senate bill 951 (sb 951) on september 30, 2022, which will remove the wage cap on income subject to california’s state disability.